What Wealthy Families Need to Know - Corporate Transparency Act

The Corporate Transparency Act (CTA) is the newest legislation impacting ultra-high-net-worth (UHNW) families, emerging amidst heightened efforts by the US government to combat financial crimes and increase transparency. Per the FAQs from the US Treasury’s Financial Crimes Enforcement Network website, the CTA was passed “as a part of the US government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures,”(1) and as a result, the US is requiring significant information about private entities and their beneficial owners to be reported.

Given the volume of reporting required, especially on existing entities, many law firms are sending out notice of the new law to their clients. Firms are separately grappling with whether they will have the resources to help clients with the actual filings and compliance. Additionally, firms such as CT Corp and CSC (who help businesses with registered agent and other business compliance matters) are ramping up efforts to be part of the solution but they may not possess the same level of familiarity with their client's situation as the client's attorney.

It is worth noting that there have been some challenges since this law came out as to whether it is constitutional. As of March 1, 2024, there has been a ruling by a federal district court in Alabama that the CTA is unconstitutional, however, the results of this ruling are limited to the plaintiffs in the suit (the National Small Business Association or its members). Thus, other entities who are not part of that group are currently still subject to complying with the CTA, though this is likely to continue to evolve through the remainder of 2024.

If the CTA remains a law, here is what you need to know (based on current guidance):

Reporting Company

Any corporation, LLC, limited partnership, or other entity that is created by a filing with the secretary of state is considered a reporting company. There are exemptions for large operating companies (>$5m of revenue and >=20 employees), 501c organizations (including private foundations), banks, securities, and financial services businesses (RIAs, B-Ds), insurance firms, accounting firms, and public utilities.

Many UHNW individuals use LLCs and partnerships in their estate plan and for real estate holdings, which fall under this new rule.

Beneficial Owner

An individual or trust that owns more than 25% or exercises substantial control of a reporting company is considered a beneficial owner. Substantial control can be held by senior officers, directors, general counsel, and individuals with power over removing those individuals. To the extent that a trust meets the definition of a beneficial owner, the following individuals are also considered beneficial owners:

- Trustee and trust protector

- Individual that is the sole beneficiary of income and principal or has a right to demand a distribution

- Grantor who retains the right to revoke trust or can withdraw trust assets

- Individual that holds a lifetime power of appointment over trust assets

- Individual who can amend documents of the reporting company or remove/replace officers/board

Given the prevalence of Trusts as a wealth transfer and asset protection tool, we expect significant reporting requirements for UHNW families.

Beneficial Owner Information

Beneficial owner information is required to be reported for all beneficial owners of a reporting company and includes legal name, physical residence address, date of birth, picture ID, and a unique identifying number (such as license or passport). Additionally, any time this information changes (for example a physical residence changes or a minor turns 18), updated information is required to be filed typically within 30 days.

Capturing and communicating this information to the client’s attorney or their agent to use in the filing will be critical for UHNW families to be in compliance with the new law.

Filing

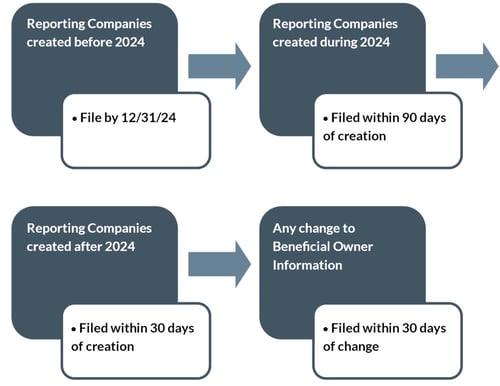

Filing can be done online and can be completed by an agent for the reporting company. Failure to file may be a civil fine of $500/day, a criminal fine up to $10k, and two years in prison. As the law came into effect in 2024, there a few different tiers of filing deadlines:

It is critical to have an advisor familiar with the filing requirements and proactive in making sure UHNW families are in compliance.

Conclusion

The Corporate Transparency Act stands as an impactful new piece of legislation, particularly for ultra-high-net-worth families given their complex financial structures. It is crucial that UHNW families remain vigilant in meeting the requirements set forth by the CTA.

At Lake Street, we are dedicated to supporting our clients in understanding and fulfilling their obligations under this new law. By staying informed and proactive, we can navigate the nuances of the CTA together, ensuring compliance and peace of mind for our client families.

If you enjoyed this article, please subscribe to get our insights delivered straight to your inbox.

(1) Source: Financial Crimes Enforcement Network, Beneficial Ownership Information Reporting