Crafted with an unwavering dedication to prioritizing your interests and safeguarding your family's legacy, Lake Street aims to build durable, multi-asset class portfolios to meet your financial goals.

As fiduciaries, we prioritize the best interests of our clients above all else, guiding every decision we make. We operate on a fee-only basis and do not accept commissions or compensation for recommending investments.

Our investment team maintains a sharp focus on what we can control:

- Minimizing tax and fee burdens in efficient markets.

- Identifying inefficient markets and applying a rigorous alternative investment selection process to capitalize.

Our Investment Philosophy

Our investment decisions are guided by the following core beliefs:

- Asset allocation is the primary driver of returns.

- Maintaining a long-term view is imperative to achieving long-term objectives.

- The investment world is competitive, most markets are efficient, and competition fluctuates over time. Active management should only be utilized in asset classes offering the potential for true outperformance.

Crafting Your Unique Portfolio

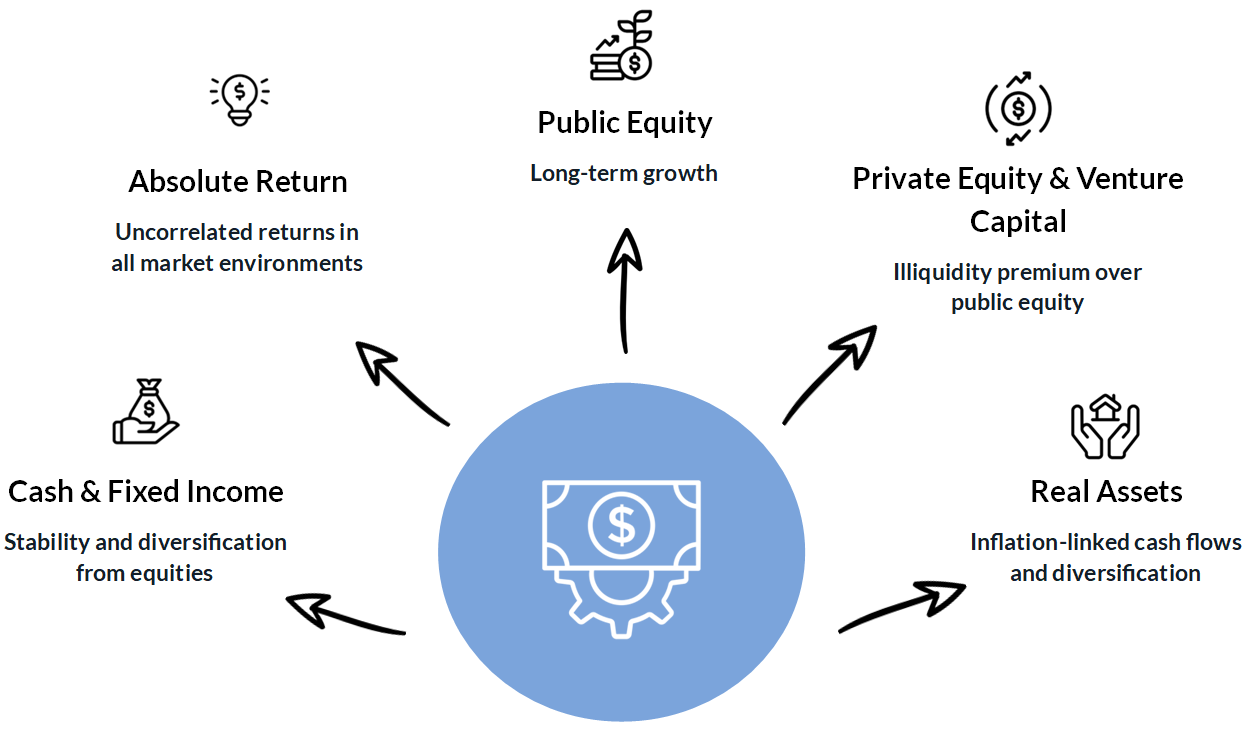

Lake Street employs a five asset class model, with each class serving a distinct role in your portfolio to maximize long-term returns.

By comprehensively understanding your needs, objectives, and risk tolerance, we craft a customized portfolio specifically tailored to achieve your individual goals.

Manager Selection Strategy

We optimize portfolio performance with a dual strategy - deploying low-cost index funds for efficient public markets and engaging top-tier managers in alternative asset classes where outperformance potential exists.

Our size grants us access to exclusive opportunities, cultivating enduring competitive edges seeking stronger long-term performance.Identifying Inefficient Markets

We leverage both actively managed and index-oriented investment vehicles. This approach allows us to minimize fees and taxes in more efficient markets, while selecting funds we believe have the best opportunity to outperform in less efficient markets.Competitive Edge

Actively managed investments are recommended only when we feel they have a competitive advantage over their peers. We use qualitative and quantitative metrics to seek out managers we believe will outperform in each market.Continuous Improvement

As competition intensifies over time, active managers must embrace a mindset of continuous improvement to stay ahead. We seek managers who are receptive to fresh ideas and innovative strategies, avoiding entrenched 'status quo' attitudes.Private Investment Opportunities

Through our expansive network, Lake Street sources opportunities across all asset classes. Through our rigorous evaluation process, from sourcing to final committee approval, we ensure objectivity in selecting only opportunities that meet our high standards.

- Due to Lake Street’s size, we are able to access high-quality institutional asset managers at negotiated minimums and fees for our clients.

- Lake Street has robust sourcing capabilities, we review 300+ alternative investment opportunities per year, which allows us to identify the best-in class.

- Private investments include substantially more administrative tasks than public market investments. Our team has a process to handle the additional work associated with these investments.

.png?width=375&height=373&name=benegits%20of%20(1).png)

Investment Insights

Stay up-to-date on our latest insights.