Weighing Income and Estate Tax Savings with Future Flexibility

When someone with a concentrated stock position embarks on wealth transfer to future generations, a common strategy is to gift the stock to an irrevocable trust known as a SLAT (Spousal Lifetime Access Trust). The SLAT allows for assets to be held for future generations, but also retains the flexibility for the grantor’s spouse to receive distributions if necessary.

If you are in the enviable position of having that concentrated stock position qualify for QSBS (Qualified Small Business Stock) treatment – meaning that each owner can shelter $10m of gains (or 10X basis, if greater) from capital gains tax – you may not be able to retain the flexibility offered by a SLAT while still maximizing the amount of income tax that can be sheltered by QSBS.

When weighing income and estate tax savings with future flexibility, how do you assess which strategy is right for you?

Let’s take two hypothetical couples and see how we could help them approach the decision:

Alice and Archie Adams and Bob and Barbara Barnes are both faced with the same situation.

Alice Adams and Bob Barnes are executives at biotech companies in Boston and both expect that their companies will be acquired in the next year. Both have been with their companies since inception (seven years ago) and have confirmed that their stock in the company qualifies for QSBS treatment. Today, each of them owns $40m worth of stock. Both couples would like to be smart about taxes and gift some of their stock to their children.

Lake Street would start by helping each family get comfortable with their decision by framing their options and the associated trade-offs. First we’d discuss what their primary goals are.

Each family defined their goals in the following order:

| Alice and Archie | Bob and Barbara |

| 1. Pay as little tax as possible 2. Maximize total family wealth 3. Transfer wealth to their children so they can be financially independent |

1. Enjoy the benefits of financial independence and live the lifestyle they want 2. Transfer wealth to their children so they can use it to supplement their lifestyle |

After identifying priorities and goals, we would then discuss the two types of irrevocable trusts commonly used in their situation:

QSBS Multiplier Trust (otherwise known as a non-grantor irrevocable trust)

The QSBS Trust is treated as a separate taxpayer for income tax purposes and allows you to take advantage of up to an additional $10m of tax-free QSBS gains. Because the trust stands on its own for income tax purposes, it is also possible to change the “resident state” of the trust to a state with no income taxes.

SLAT (Spousal Lifetime Access Trust)

The SLAT allows you to make a complete transfer of assets for estate tax purposes, but retain flexibility by allowing the spouse of the grantor of the trust to receive trust distributions. For income tax purposes, the SLAT is treated as being one and the same with the grantor.

A comparison of the two trusts’ features is shown below:

|

QSBS Multiplier Trust (Non-grantor Irrevocable Trust) |

SLAT (Spousal lifetime Access Trust) |

|

| Income tax savings from QSBS Multiplier |

Yes (up to $10m or 10X basis per trust) |

No |

| Estate tax savings from gifting | Yes | Yes |

| Future access by stockholder | No | No |

| Future access by spouse | No | Yes |

| Ability to avoid MA income tax going forward | Yes | No (while Spouse is a beneficiary) |

| Ability to make tax free gifts to trust by paying trust’s income taxes | No | Yes |

The decision each couple is faced with is- would they rather have the flexibility of one spouse being a trust beneficiary (while they are alive and still married) along with the ability to make tax-free gifts by way of paying income taxes on the trust ~OR~ would they rather save capital gains taxes on an additional $10m of gains and be able to avoid state income taxes on trust assets going forward.

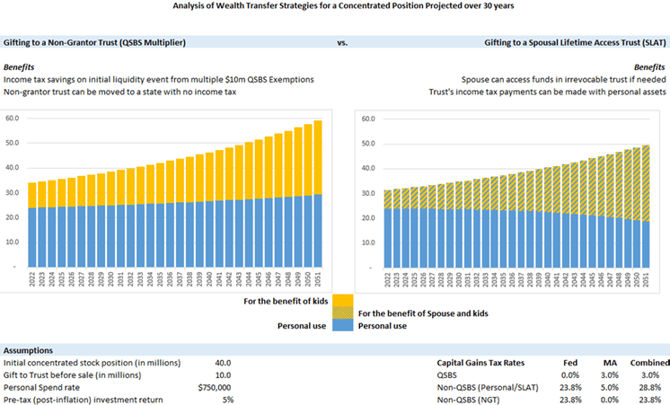

A projection of the impact of the two choices over time is presented below:

Alice and Archie felt comfortable that they would have sufficient assets to live the lifestyle they wanted and opted to use the QSBS Multiplier Trust, which would save them the most in taxes.

Bob and Barbara’s primary concern was retaining flexibility for themselves, so they opted to use the SLAT strategy, which left them with access to significantly more of the wealth.

Whatever your goals and chosen strategy, it is important to engage with a financial planning professional to ensure you have thought through all of the ramifications.

If you would like assistance developing or examining your estate planning strategy, please don’t hesitate to reach out and speak with one of our experienced advisors.

IMPORTANT DISCLOSURES AND DISCLAIMERS

This hypothetical scenario is provided for illustrative purposes only and does not represent work we’ve done on any client of Lake Street Advisors nor is it intended to be representative of any client experience. Instead it is meant to provide an illustration of Lake Street Advisors approach to planning and tax strategies we believe would be appropriate given the facts and circumstances of the hypothetical case presented.

An individual’s real world experience may vary significantly from the results portrayed in the hypothetical case based on the unique facts and circumstances of each individual. There is no assurance that Lake Street Advisors would be able to achieve similar results as those portrayed in similar situations.

This hypothetical case is not to be interpreted as a testimonial or endorsement of Lake Street Advisors nor the advice or services we provide. We make no representation that any past or present client that may have engaged us to provide similar advice or services to those described in the hypothetical case approves of Lake Street Advisors or its services.

This hypothetical case study is distributed for informational purposes only. The opinions expressed may contain certain forward-looking statements and should not be viewed as recommendations or personal investment advice nor should it be considered an offer to buy or sell specific securities. All information contained in this hypothetical case are obtained from what we believe to be reliable sources.

Past performance is not an indication of future returns. Any legal, tax, and/or insurance related information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal, tax, or insurance advice. We do not provide legal, tax or insurance advice. Always consult an attorney, tax, or insurance professional regarding your specific situation.

Our statements and opinions are subject to change at any time without notice and should only be considered in the context of a diversified portfolio. Individual securities or markets mentioned in this hypothetical case study are not necessarily held in client portfolios and our opinions expressed about them should not be seen as a recommendation to buy, sell or hold any of them.

You may request a copy of the Lake Street Advisors firm Brochure, Form ADV Part 2, which describes the risk factors, strategies, affiliations, services offered, fees charged, and other important disclosures.