Moving a MA Irrevocable Trust to NH - Income & Estate Tax Consequences

Should I move my MA Irrevocable Trust to NH if my goal is to maximize what my children will inherit?

Starting in tax year 2023, Massachusetts enacted a new “Millionaire’s Tax”, which imposes an additional 4% tax on income over $1 million. This has motivated many wealthy families to consider ways to shield more of their income from the state. This article focuses on whether the state income tax savings from moving an irrevocable grantor trust from Massachusetts to New Hampshire (or to another state that does not have an income tax) is worthwhile if one’s goal is to maximize the amount of wealth transferred to their beneficiaries.

To complete the analysis, we evaluate the following hypothetical example:

John and Mary Smith are a married couple living in Cambridge, Massachusetts, and are both retired at 50 years old. The Smiths are in good health and expect that at least one of them will live until age 90.

John and Mary were successful entrepreneurs who sold their family business, and now have a total net worth of $100 million - $70 million of that is in their names personally and the remaining $30 million is in an irrevocable trust for their children and grandchildren. This irrevocable trust is set up as a grantor trust, meaning the Smiths pay the tax on income generated by the trust. They used all of their lifetime gift and generation-skipping tax (GST) exemptions when funding the trust.

The Smiths’ main goals are to maintain their current lifestyle and to maximize the amount passed on to their children. The new 4% Millionaire’s Tax in Massachusetts has motivated them to find ways to reduce their tax liability. However, they love their community and do not want to move. They wonder if moving their irrevocable trust to New Hampshire would help them achieve their goals since this would eliminate Massachusetts state income taxes on the trust’s assets.

While this move would clearly save MA state income taxes, it is important to consider the whole picture.

Often overlooked in the analysis of moving the situs of a trust is that the trust would have to become a non-grantor trust, forcing it to be a separate tax entity responsible for paying its own income taxes. Because of this, John and Mary can no longer pay the income taxes generated by the trust without making a taxable gift.

In this situation, Lake Street would model the impact on the ultimate wealth transferred to the Smiths’ beneficiaries under two scenarios:

- Keep the irrevocable trust as grantor trust subject to Massachusetts income taxes

- Terminate grantor trust status and move the irrevocable trust to New Hampshire

Hypothetically, the Smiths and Lake Street jointly agree on the following assumptions:

- Gross investment return of 7% annually

- The investment portfolio will generate 5% of taxable income annually

- The Smiths will take a $1 million annual draw from the inside estate portfolio to support their lifestyle, adjusted annually for inflation at 3%

- The assumed effective Federal income tax rate is 30%

- The assumed effective MA income tax rate is approximately 9%

- The assumed effective estate tax rate (combined Federal and MA) will be 49.6%

- 40 year time horizon

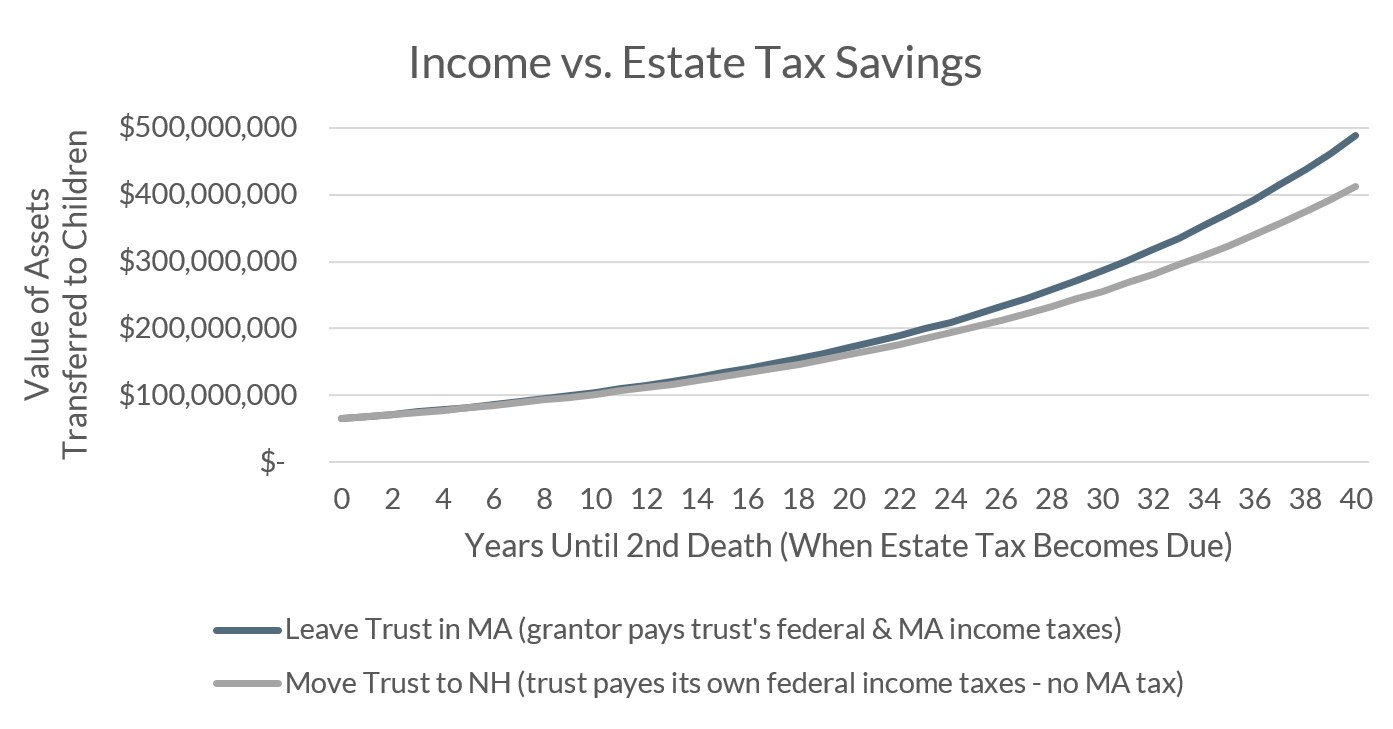

By keeping the grantor trust status intact and the Irrevocable Trust in MA, the total wealth that the Smiths are able to pass to their beneficiaries after 40 years is approximately $75 million higher than if they had moved the trust to New Hampshire.

Though the Irrevocable Trust was no longer subject to MA income taxes, it had to pay its own income taxes, which drew down trust assets. Simultaneously, because the Smiths no longer paid the Irrevocable Trusts’ income taxes, their personal estate grew faster than it otherwise would have. However, this extra growth was effectively cut in half at their passing due to estate taxes levied on their personal assets.

Although moving a trust to avoid state income taxes may appear to be a good wealth building strategy on its face, this would have resulted in less assets transferred to the Smiths’ children due to the estate tax consequences. An advisor who is not intimately involved in the holistic planning for the Smiths may have suggested moving the trust to save on state income taxes alone. As we can see from the example, this would have been bad, costly advice.

Conclusion - the Smiths are one example.

In some cases (e.g., if a client is looking to maximize the amount that goes to charity), it may make sense to move from a Massachusetts-based grantor trust to a New Hampshire-based non-grantor trust. It is essential to choose an advisor who considers the whole picture and takes the time to fully understand your goals.

If you would like to review any of the items discussed in this article, or explore how an advisor could bring value to your financial wealth management, please do not hesitate to reach out.

If you enjoyed this article, please subscribe to get our insights delivered straight to your inbox.