Investing in Private Markets: Lake Street Advisors’ Private Capital Diligence Process

Why Private Markets?

Private markets consist of investments not listed on a public exchange. The main asset classes within private markets include private equity, private credit, and private real assets. Private investment markets have exhibited strong, consistent growth since the new millennium. For example, according to the Preqin database, private markets have exhibited 6.3x growth / 13.7% Compounded Annual Growth (CAGR) from 2005 through the end of 2021.

Historically, large institutional investors such as pensions, endowments, and foundations were the sole players in private markets, with portfolio allocations generally ranging from 10-20%[1]. Therefore, high-net-worth families and individuals did not have the same opportunity to invest in private markets due to these investments lack of accessibility and high complexity. However, as private markets have grown, the tide has turned as more RIA’s and family offices have built out their private investment capabilities to provide access to these asset classes for high-net-worth investors.

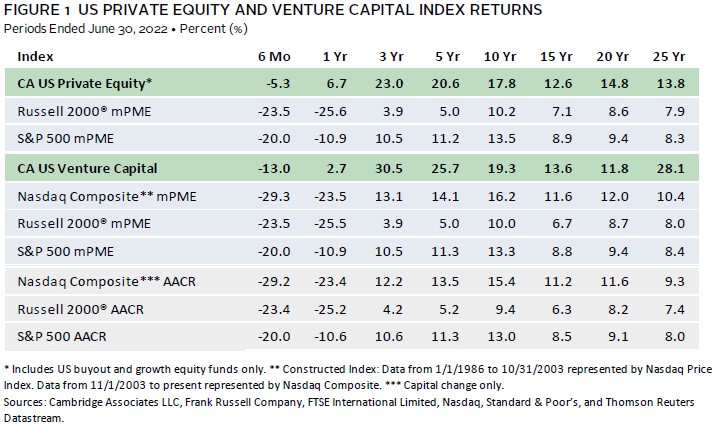

The main reason for why the demand of these private investments has grown are the attractive returns in comparison to public markets. Using private equity as an example, the below graph shows how private and venture capital have outperformed their public market comparable (S&P 500 and Russell 2000) over long-term horizons; this can be attributed to the illiquidity premium or incremental return that compensates an investor for owning an asset that is not liquid.

The illiquidity premium compared to public markets is why firms, such as Lake Street Advisors, have added resources to provide access for clients to high barrier to entry private markets.

Lake Street Advisors are active and engaged in private markets on behalf of our ultra-high-net-worth client base. For example, we consistently source and review 300 – 400 private capital opportunities on an annual basis. We then deploy an in-depth, four-staged diligence process that we utilize to review the private capital opportunities that we deem attractive. Our investment committee votes to approve to move forward or reject opportunities at the end of each stage.

This process ensures we are evaluating every investment opportunity in a balanced and equitable fashion. The private market opportunities and managers that end up making it through our diligence process and are approved for our clients’ portfolios consistently set themselves apart from other ideas by having superior attributes in the following:

- Fishing hole: The target market where the manager invests. We strive for markets characterized by fragmentation and low competition

- Competitive edge: Characteristics of a manager that makes them more attractive than other investors in their market/space

- Culture of continuous improvement: Efforts made to increase competitive edge(s)

Lake Street Private Market Investment Example

While we invest across the entirety of the private market asset class spectrum, it may be helpful to share the process for one of Lake Street’s latest approved private equity strategies and what we found valuable about this specific opportunity.

At a high level, the strategy was a private equity buy-and-build fund that invests in blue-collar, family-owned, or closely-held lower middle market businesses that serve misunderstood and fragmented industries in commercial and industrial end markets throughout the United States. We were able to source this specific opportunity from the network of our investment team.

Fishing Hole

What we initially liked about this opportunity was the fishing hole. First, the fund was targeting smaller businesses with $2-15M of individual EBITDA. There are over 125,000 companies with revenues between $10M-99M that fall in the target range of the strategy[2]. In addition, 41% of these small businesses are owned by Baby Boomers[3]. Approximately 10,000 Baby Boomers reach retirement age each day[4]. Therefore, we concluded that with more Baby Boomers retiring each day, the size of the target businesses provided a unique buying opportunity in a fragmented section of the market.

Second, we were attracted to the types of businesses that the fund was targeting; these include necessary or “need-to-have” businesses with recurring revenues and high margins. Examples of these target industries include, street and parking lot sweeping service companies and highway line striping and pavement marking companies. We believed that these types of businesses were less competitive for private equity investments since they exhibit 3-5% annual organic growth, which is much lower than other industries, such as technology and healthcare.

The historical attractive entry points of the fund’s investment team supported this thesis. For example, across 32 prior investments in their target industries, the team had a weighted average purchase price multiple of 5.6x EBITDA, versus the median private equity middle market purchase price multiple of 11.6x EBITDA[5]. In summary, we believed the fishing hole had the opportunity for low entry points relative to other private equity industries in which we viewed as attractive.

Competitive Edge

It was evident that the target industries, or fishing hole, was fragmented (as described above). Therefore, we honed in on what set this strategy apart from other investment strategies in their fishing hole. The main edge we identified was a thesis-driven, in-house origination, and sourcing process.

In summary, this specific manager has a dedicated three-person origination team that solely focuses on proactively sourcing attractive industries and off-market opportunities within their target verticals by engaging with tax professionals, attorneys, and business owners in their fishing hole. The origination team had successfully sourced over 35 acquisitions for the investment team at low entry points, which supported a necessary edge in a fragmented and misunderstood fishing hole.

Continuous Improvement

Finally, we wanted to vet that the manager was proactively looking for ways to maintain their competitive edge in their fishing hole. The firm had implemented a process that every team member (origination and investment team) is accountable for bringing a target industry with supporting data to the table to discuss on a monthly basis. The reason was to stay ahead of the curve on which industries are most attractive for their strategy.

Conclusion

The above is a high level example of the attributes in which we look for when sourcing private investment opportunities. If you would like to discuss the information at hand or our private investment capabilities more in-depth, please do not hesitate to reach out to us.

[1] Source: McKinsey Global Private Markets Review 2021

[2] NAICS Association as of February 2022

[3] Guidant Financial, Boomers in Business: 2020 Trends

[4] Federal Reserve, Distribution of Household Wealth in the U.S. since 1989

[5] Pitchbook Q1 2022 US Middle Market Report; reflects rolling three-year median

If you enjoyed this article, please subscribe to get our insights delivered straight to your inbox.