Making the Right Choice Between Charitable Gift Annuities and Charitable Remainder Trusts

For many ultra-high net worth families, giving to charity is an important component of the overall family wealth strategy. Many people regularly make “obligatory” gifts to charity – the ongoing, smaller one-time donations requested from friends and family, schools that family members have attended, and so on; however, ultra-high-net-worth families are more likely to engage in deliberate, long-term giving strategies as well.

The focus of these giving strategies is usually a cause or issue the family is passionate about, or a specific problem the family would like to solve by using their wealth. Careful consideration is given to flexibility needs, tax implications, and the timing of when gifts should be made. These strategies may include the use of charitable giving vehicles such as, private foundations, donor-advised funds (DAFs), and charitable lead annuity trusts (CLATs).

There are two additional strategies that can be used to make charitable gifts when a donor passes away - one is a charitable remainder trust (CRT), the other is a lesser-known vehicle called a charitable gift annuity (CGA). A number of non-profit organizations offer CGAs as a giving vehicle for their donors and will often approach their most notable benefactors inviting them to create one directly with the charity. But is this option the ideal charitable giving strategy for ultra-high net worth families?

Charitable Gift Annuities

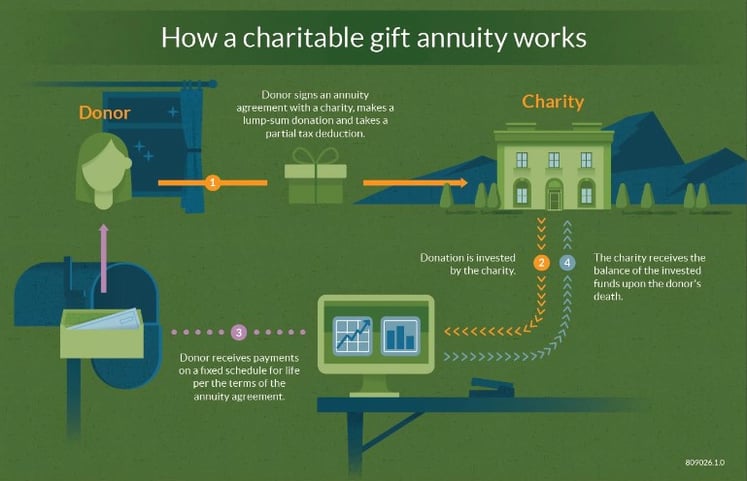

In summary, a charitable gift annuity is a contract between a charity and a donor whereby the donor makes a large gift to the charity, and in turn, the charity invests the donation and promises to make lifetime income payments back to the donor. The donor receives a charitable deduction for a portion of the CGA amount when it is created. At the donor’s passing, the charity receives the remaining value of the CGA after the lifetime payments have been made to the donor.

Source: Fidelity Charitable

Charitable Remainder Trusts

A charitable remainder trust works similarly to the charitable gift annuity. It is an irrevocable trust created and funded by the donor, which can be managed by the donor’s investment advisor alongside of their existing investment portfolio. Not only does a CRT allow for a more generous income payment structure, but the donor also has the freedom to name the charitable beneficiary of their choice – and, more importantly, change the charitable beneficiary in the future if desired. If the family has a private foundation or a donor-advised fund, either of these vehicles may also be listed as the charitable beneficiary! CRTs are also a great tool to use when a charitably inclined individual is facing a significant liquidity event, or has a considerable appreciated concentrated position they are trying to liquidate in a tax efficient way, while maximizing their income payments.

Key differences of a CGA vs. a CRT:

Guaranteed income payments – the charity will guarantee a fixed amount determined at the time the CGA is funded to be paid to the beneficiary for their lifetime; this is ideal for someone who is interested in this type of giving structure and needs a fixed, predictable income stream (subject to any financial solvency risk of the charity!)

Ease of administration and management – there are minimal administrative costs for a donor entering into a CGA agreement, making this a great path for smaller donations. The charity will do the bulk of the heavy lifting in setting up the CGA.

The key differences outlined above could potentially be viewed as a downside for ultra-high net worth donors:

Potentially smaller income payments – the CGA beneficiary doesn’t share any of the CGA pool’s investment appreciation or decline in value over the term of the agreement. Said another way, if the markets performed well during the term, the payments would remain at what is likely the lesser previously agreed upon amount.

Less control over administration and management – the CGA is fully administered by the charity, leaving the income beneficiary with less control overall. The income beneficiary (or their investment advisor) isn’t allowed to manage the funds placed into the CGA. There also may be limitations put forth by the charity as to what assets they are willing to accept for funding.

Flexibility regarding the charity receiving the remainder – in addition to the lack of investment control, a donor also cannot typically “undo” a CGA and direct the remainder assets away from the charity associated with the CGA. If the charity did something to ultimately lose the donor’s support, they would likely still receive the remainder amount against the donor’s wishes.

Due to the lack of flexibility associated with the CGA for ultra-high net worth donors, they may want to consider an alternate vehicle if they would like to receive income while making a gift to charity at their passing. If the donor’s financial situation and goals align with this concept, a CRT may offer more flexibility and can solve for other planning issues at the same time.

Conclusion

For ultra-high net worth donors, exploring the different charitable giving strategies available with an advisor is paramount to ensuring charitable goals are achieved. Additionally, an experienced advisor can help put a strategy in place that’s tailored to the client’s specific wealth needs. Please do not hesitate to reach out to speak with an advisor at Lake Street.

If you enjoyed this article, please subscribe to get our insights delivered straight to your inbox.