The Hedge Fund Life Cycle and Why It Matters

Growing up, one of our family traditions was to order two plain cheese pies every Tuesday from a local pizzeria. The restaurant ran a “buy one, get one” promotion on Tuesday so it was a great way for my parents to feed our growing family for that night, plus have a couple of extra slices left over for later. Growing up in Maryland, this pizza was the closest you could get to a quality New York City-style slice (in my opinion).

Over time, as the restaurant grew in popularity, they began to open more stores, raise prices, and no longer offered their Tuesday special. After visiting a couple of their other locations, I could tell that the pizza simply wasn’t as good as it used to be. Over time, our family began to order less and less from the restaurant, as both quality and value had declined.

A hedge fund, like a pizzeria, is a business. The goal of any business is to maximize utility for its owners. Often, this is simply earning as much profit as possible, but there are other factors that influence their decision making process as they run their business. Like a pizzeria, the quality of the end product may suffer as a result of increased focus on profits for the manager. For hedge fund managers, factors that drive their decision making include:

How They Want to Spend Their Time

Non-investment related responsibilities can take up considerable time for hedge fund managers. For example, a manager must decide how much time they want to spend interacting with current investors and marketing the fund to prospective investors. From my experience, the best investors usually aren’t the best marketers and vice versa. If the manager isn’t interested in spending a lot of time on these activities, they must either hire additional employees or third parties to perform those functions, or else the fund will likely struggle to grow its asset base.

As the firm hires additional employees, the owner must think about how much time he or she wants to spend on management of the business and developing the culture of the firm. Managing a fifty person organization with multiple partners is much more difficult and administratively challenging than running a three person shop where there is one decision maker. As additional employees are hired, their incentives should be structured in a way to align with investors to ensure that the business is successful over the long term. No matter how skilled an investor is, if the economics of the business are unstable, it will not be a successful long-term investment.

The Makeup of the Investor Base and Other Stakeholders

The makeup of a fund’s investor base is an important business risk to consider. An entrepreneurial single family office with a very high-risk tolerance has very different objectives than a conservative pension fund with fixed obligations. Properly setting performance expectations with investors is critical for hedge funds since investors can withdraw their capital as they see fit (to varying degrees depending on the fund’s terms). If half of a fund’s assets are redeemed in a quarter, this has a tremendous impact on the fund’s revenues and could lead them to rethink staffing, infrastructure, and other overhead expenses of the fund.

In order to entice initial investors for a startup hedge fund, firms are increasingly selling profits interests in their funds to third parties, either through revenue sharing agreements, equity warrants, or simply buying a stake in the General Partner. Typically, a fund needs at least $10m in assets under management (AUM) in order to become a viable business, which is a challenge for most aspiring hedge fund managers. The majority of potential investors like to see an in-sample track record with a material asset base before investing, so this creates a “chicken or the egg” problem. While selling a GP stake might be a solution to this issue, it typically incentivizes the firm to grow as large as possible because that will likely maximize value for the initial investors.

The Fund Manager’s Personal Financial Picture

The financial stability of the fund manager and what percentage of their personal net worth they have invested in the fund has a deep impact on how a fund will operate. This is particularly important when it comes to risk management decisions. For example, a well-seasoned fund manager with a personal net worth of $100m with $5m invested in his fund will likely invest very differently than a younger manager worth $5m who essentially has his entire net worth invested in the fund.

If a manager has a low percentage of their net worth invested in the fund, it can lead to a “trader’s option” which could encourage the firm to take excessive risk. If their bets pay off, the manager could stand to make millions, while if the bet does not work, their losses will be limited. At the other extreme, you don’t necessarily want a manager to put their entire net worth into their fund if the fund has a low risk mandate. Again, this could encourage the manger to take more risk than investors would like.

The Hedge Fund Life Cycle

The life cycle of a business refers to the various stages of development of a company. In some ways, the life cycle of a hedge fund may be similar to a pizzeria. As a firm matures, the incentives, opportunities, and risks of the manager change over time, which all have important implications in the manager selection process.

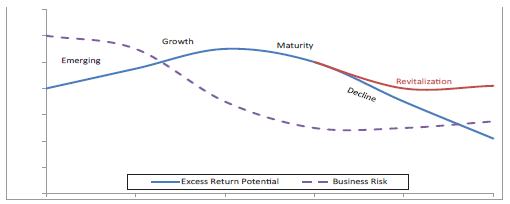

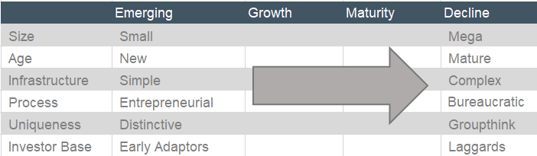

As illustrated in the exhibits below, Fund Evaluation Group (FEG) defines the hedge fund life cycle in the following stages:

- Emerging: Small and entrepreneurial funds with high business risk and increasing excess return potential (or alpha).

- Growth: Relative to emerging, the fund has decreasing business risk and increasing excess return potential (or alpha) but at a less steep rate. The process and infrastructure of the fund may become more complex during this stage.

- Maturity: Minimal business risk and flat or decreasing alpha potential. At this stage, the firm and its strategy has likely become very institutionalized and “mainstream”.

- Decline: Large, bureaucratic funds with sharply decreasing alpha potential or revitalization (funds with stable and consistent alpha potential but lower than the growth and maturity phases).

Source: CAIA Hedge Fund Life Cycle

Source: CAIA Hedge Fund Life Cycle

While the shape of the curves and the length of each stage is different, the majority of funds follow this cycle. The ideal time for an allocator to invest is when excess return potential is highest and business risk is at its lowest. This is typically between the growth and early maturity stage. However, since all allocators are looking for funds with those attributes, we are often faced with two scenarios.

The first scenario is a fund reaches the maturity phase and it closes to new investors, as most strategies tend to be capacity constrained. For example, assume a hedge fund wants to have a concentrated portfolio of ten small US companies that have $1B market capitalizations or less. If the fund does not want to buy more than 10% of companies shares (which leads to additional reporting requirements), the maximum capacity of the strategy is less than $1B. Due to capacity constraints, obtaining an allocation to these funds is challenging for prospective investors.

The other scenario is that a fund accepts too much investor capital in the early maturity stage which forces them to develop new strategies that go beyond their original core competency in order to scale (such as strategy drift to large-cap companies or a less concentrated portfolio). While some firms are able to do this effectively, many are not, like my local pizzeria in Maryland which favored growth over quality. This will typically lead to decreased alpha generation and a shift to the decline stage rather than the revitalization stage.

Closing Thoughts

Understanding where a firm lies in its fund life cycle is an integral part of Lake Street’s initial and ongoing due diligence process. In order to receive capacity into high quality funds with the highest alpha potential, investors sometimes have to invest and develop relationships earlier in a fund’s life cycle. Our investment philosophy centers on process, competitive edges, and continuous improvement so the limited track record that these funds possess is not a disqualifier for us. While this approach does entail taking on more business risk, it can be worthwhile if it allows you to gain access to highly skilled managers that otherwise would be closed to investors later in the fund’s life cycle. We also avoid large, complex, and bureaucratic hedge funds, as they are more likely to be experiencing either the decline or revitalization stage.