Sampling of our Favorite Investment Books

Summer is in full swing, so we thought we would share some investment-related books that have helped form the foundation of Lake Street’s investment philosophy and process.

Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment

By David Swensen

David Swensen is the chief investment officer of Yale University’s endowment, and is widely credited with creating the “Yale” or “Endowment” model of investing. Philosophically, Swensen believes that most traditional liquid investments like U.S. large capitalization stocks are efficiently priced. Even if you are able to identify a strong manager, traditional investments generally have little dispersion between top and bottom performers, which Swensen utilizes as a proxy for skill. In contrast, the Yale model places a heavy emphasis on illiquid and alternative investments where there is high dispersion between top- and bottom-performing managers (see chart below). Examples of these broad alternative assets include Venture Capital, Private Equity, Hedge Funds/Absolute Return, and Private Real Assets. Swensen also avoids market timing to generate returns and strictly adheres to allocation targets by rebalancing Yale’s portfolio daily. While we have incorporated many components of Swensen’s philosophy into our own, we have made some alterations — primarily because our clients typically have different objectives than a large college endowment has. As an example, endowments are tax-exempt institutions while our clients are typically subject to the highest tax rates. For actively managed mutual fund and hedge fund strategies, significant turnover can cause material tax costs, which make these asset classes less attractive for taxable investors compared to endowments.

Superforecasting: The Art and Science of Prediction

By Phillip Tetlock and Dan Gardner

Tetlock’s Superforecasting examines why some forecasters are more accurate than others, and the common attributes of these “superforecasters”. While this book does not explicitly cover investing, its applications to investing and investment manager selection are widespread. For example, you often hear a fund manager make a prediction like “xyz is likely to occur.” What is the forecaster’s definition of “likely”? Is it 50%, 70%, or 99%? When evaluating someone’s track record as a forecaster, it can be difficult to hold them accountable if details like this are not clear. Even if a forecast is properly defined, it can be difficult to evaluate a forecaster without a sufficient sample size. If a meteorologist says there is an 80% chance of rain and it does not rain, it does not mean that he is a poor forecaster (i.e., predicting an 80% chance of rain also means that there is a 20% chance that it does not rain). The financial media typically glorifies pundits who may have made one or two accurate forecasts, so it is important to keep these concepts in mind as you make investment decisions. Many times, there isn’t enough available data to judge the quality of the forecaster (or investor). In this case, we spend a lot of time focusing on an investment manager’s investment process. A typical process among superforecasters includes:

- Breaking the question down into smaller components

- Identifying the known and the unknown

- Looking closely at all of your assumptions

- Considering inside and outside perspectives

- Exploring similarities between your views and the views of others

- Expressing your view with a finely grained scale of probability

- Updating your forecast often as you receive new information

- Being able to change your opinion as facts change

Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor

By John Bogle

A good introductory book on investing, John Bogle’s philosophy has stood the test of time since creating one of the first index mutual funds in 1975. Bogle’s investment philosophy is rooted in maintaining a long-term focus, keeping fees and taxes low, and holding a simplified investment portfolio. In the book, Bogle is critical of the mutual fund industry as a whole, arguing that they do not outperform after accounting for fees and taxes. Even if you are able to identify well-run actively managed funds, success often brings increased assets to manage, which makes it more difficult to find bargains and outperform on a going-forward basis. Increased trading also increases taxes, which is another friction that must be overcome. If you add these externalities together, holding an “average” index fund will actually deliver above-average results. While we do not agree with everything that is stated in this book (for example, Bogle does not think it is necessary to invest outside the U.S.), many of Bogle’s principles are a foundation of our investment process.

The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing

By Michael Mauboussin

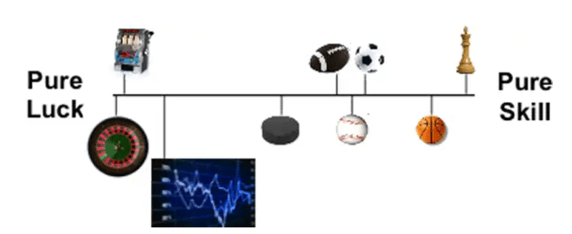

In this book, Mauboussin explores the role of luck and skill in sports, investing, and other areas. One of most important concepts in the book is the “luck versus skill continuum”. For example, roulette is a game that is pure luck, while chess is a game of pure skill (see exhibit below). Investing, like most other activities in life, entails both skill and luck, so it lies somewhere in between these two extremes. A related concept that the book discusses is the “paradox of skill”. In an activity that combines both luck and skill, as the skill of the participant improves, luck becomes increasingly important in shaping the results. Presenting this concept in an equation, the variance of skill (how skillful the participants are) + the variance of luck (which stays stable) = variance of the result. If the skill of the group increases, then the variance between their skill will shrink and luck will play a greater role in determining the outcome. Using a sports analogy, Ted Williams was the last baseball player to hit .400, in 1941. Over time, the standard deviation of batting averages in baseball has decreased. When Ted Williams hit .400, it was about four standard deviations away from the average player. If a player were to be four standard deviations away from average in 2011, he would have only hit .380. Applying this concept to investing, the skill of investors in the stock market has generally risen over time. This is due to increasing numbers of hedge and mutual funds, as well as improvements in technology, trade execution, and additional transparency required by SEC filings. The implications of this is that winning funds will outperform by less than they have in the past, and luck will play an increasing role in fund results over shorter time periods.

Other books that we recommend:

- The Most Important Thing: Uncommon Sense for the Thoughtful Investor by Howard Marks

- When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street by Justin Fox

- Thinking, Fast and Slow by Daniel Kahneman

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets by Nassim Nicholas Taleb

- The Intelligent Investor by Benjamin Graham

- The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution by Gregory Zuckerman

- Adaptive Markets: Financial Evolution at the Speed of Thought by Andrew W. Lo