The 2020 Election is Coming: What Should I Do?

As the election nears, many investors are attempting to predict how the market will react to a Trump or Biden victory. The two candidates have vastly different views on key issues such as trade, healthcare, energy, and taxes, all of which impact the economy. Understandably, clients have asked us over the last year how they should position their portfolios in the event either candidate wins the election. Politics is deeply personal and can often lead to clients expressing extreme viewpoints like, “If Candidate X wins, the stock market will crash! Should I raise cash?” Working with over 65 families, Lake Street Advisors has clients across the political spectrum, so we have heard these fears about both candidates.

While it is reasonable to expect that markets could be more volatile than normal as the election plays out, our general advice to our clients is that they should avoid the temptation to make any major changes to their portfolio specifically due to the election.

The Challenges of Making Predictions

Broadly selling stocks because of election fears is really just another form of trying to time the market. As I discussed in this article, timing the market is not a worthwhile endeavor. One of the challenges of market timing is that it involves making two decisions accurately. First, you must sell at the right time, and second, you also must buy back in at the right time, which arguably is more difficult. In addition, frictions including taxes and transaction costs will almost certainly be higher than holding onto your portfolio.

To illustrate this, let’s rewind the clock back to November 8th 2016 and assume that your belief is that Trump will win the presidency. If this occurs, you believe that it will lead the United States to financial ruin and that the stock market will tank. In preparation, you decide to sell all of your equities.

With hindsight, we know what actually occurred. During that night, as it became increasingly likely that Trump would win, S&P 500 futures fell more than 5% in premarket trading. On a personal note, I vividly remember checking FactSet that night and seeing some eye-popping red number on my screen. At this moment, our hypothetical investor looks like a genius as they successfully sold at the “right” time.

However, this is only the first step in the process! Now, the investor must decide when they should get back into the market. In retrospect we know that the S&P 500 actually closed UP 1% the day after the election, so markets adapted extremely quickly to the news. Unless the investor had bought back their equities towards the beginning of the day, the investor would have been better off simply holding their equities and ignoring the volatility.

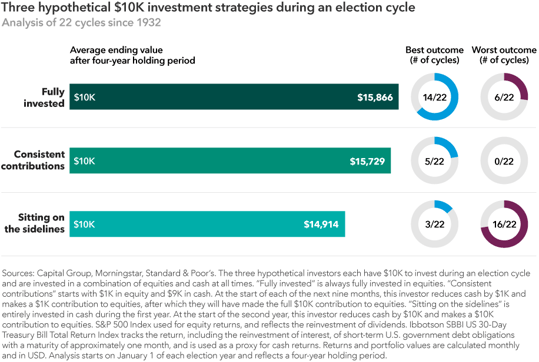

Historically, remaining fully invested during an election cycle has led to the best outcome. The exhibit below examines a historical simulation of the past 22 election cycles. In the “fully invested” scenario, an investor bought $10k of the S&P 500 at the beginning of an election year and held it for four years. In the “consistent contribution” scenario, an investor buys $1k of the S&P 500 at the start of each of the first 10 months of the election year, and finally in the “sitting on the sidelines” scenario, the investor waits to invest the $10k until January 1st of the year following the election. As you can see, remaining fully invested resulted in the best outcome in 14 of the 22 cycles, while sitting on the sidelines resulted in the worst outcome in 16 of the 22 cycles. While it is possible to benefit from remaining in cash, the odds simply are not in your favor.

Historically, Whoever Becomes President Has Had a Minimal Impact on Future Stock Market Returns

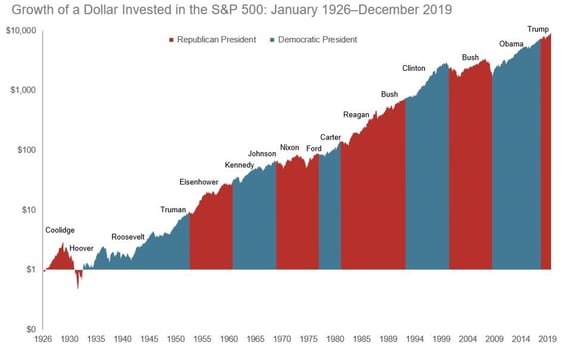

As you can see visually from the chart below from Dimensional Funds, stocks tend to go up regardless of who is in the White House over the long term. With a couple of exceptions, like Calvin Coolidge and Herbert Hoover, who were in office during the Great Depression, the S&P 500 has consistently gone up during a President’s term. There is also no discernable pattern between performance and whether or not the President is a Republican or Democrat.

These results may seem counterintuitive to some because as we mentioned earlier, the president can have a material impact on the economy. Despite this, markets are forward looking, which means that the current market price reflects the expectations of both buyers and sellers. This process is designed to account for all publically available information, so expected future changes as a result of the election are typically embedded in the price.

A second reason for this is that the stock market is influenced by many different factors which are largely outside of any political administration’s control. This includes the level of interest rates, technological innovation, the stage of business cycle, and thousands of other variables. It is impossible for any human to analyze thousands of factors at once, which people naturally find unsettling. No one likes to ask, “Why did XYZ occur?” and have the answer be, “We don’t know.” This is not a satisfying answer, nor does it make for a great headline on CNBC!

To cope with this unsettling situation, investors are often subject to a behavioral bias called the narrative fallacy. This bias addresses our limited ability to look at sequences of facts without weaving an explanation into them, or, equivalently, forcing a logical link. To cope with this, humans are hard-wired to love stories. Typically, stories have emotional content which appeals to our subconscious. Because stories have this emotional component, they are very easy to remember and help us grasp the very complex world we live in. While contriving an extreme narrative like, “Biden will destroy the economy because he’s a socialist” or “Trump will bankrupt the US just like he did with his casinos” is an appealing narrative, the actual impact on the stock market just isn’t that simple.